Introduction

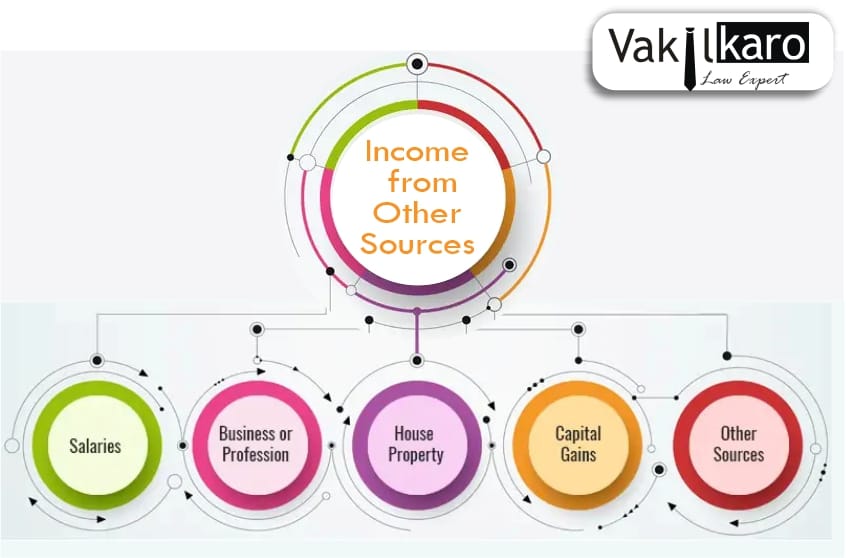

The income of the taxpayer is taxable under the Five heads of Income. The following are the heads of income:

- Salaries

- House Property

- Business or Profession

Capital Gains

Other Sources

The income not covered under the above 1-4 are taxable under the head Other Sources. It is a residuary head.

Income Chargeable under Other Sources

| S.No. | Income Chargeable under Other Sources |

|---|---|

| 1 | Dividends |

| 2 | Income from lotteries, crossword puzzles, races, card games, gambling, betting |

| 3 | Employee contribution received for PF/ESI/Superannuation Fund not deposited in the relevant fund before filing the Income Tax Return. The contribution is taxable under this head if it is not taxable under the Business or Profession head. |

| 4 | Interest on Securities |

| 5 | Income from Plant & Machinery let on hire |

| 6 | Composite rental income from letting of plant, machinery, or furniture with buildings, where such letting is inseparable. |

| 7 | Any sum received under Keyman Insurance Policy (including bonus) |

| 8 |

|

| 9 |

If shares in the closely held companies are received without consideration or for less than adequate consideration, then the difference of fair value and consideration paid is taxable.

|

| 10 | If the closely held company receives any consideration for the issue of shares that is more than the fair market value of such shares, then a difference of consideration received and fair value is taxable. |

| 11 | Any compensation received by a person in connection with the termination of employment or modification of terms and conditions. |

| 12 | Interest received on compensation or enhanced compensation |

| 13 | Any sum forfeited due to failure of transfer in capital assets. |

*Movable property includes shares, securities, jewelry, archaeological collection, drawings, paintings, sculptures, any work of art or bullion, etc.

Following gifts are not chargeable to tax:

- Gifts received from relatives

- Gifts received by an individual on occasion of his/her marriage;

- Gifts received by way of Inheritance/will;

- Gifts received in contemplation of death of the payer;

- Gifts received from any local authority;

- Gifts received from any fund, foundation, university, educational institution, hospital, medical institution, any trust or institution referred to in Section 10(23C);

- Gifts received from any trust or institution registered under section 12A/12AA.

- Share received as a consequence of demerger or amalgamation of a company under clause (vid) or clause (vii) of section 47, respectively.

- Share received as a consequence of business reorganization of a co-operative bank under section 47(vicb)

Relative means

- Spouse of the individual

- Brother or sister of the individual

- Brother or sister of the spouse of the individual

- Brother or sister of either of the parents of the individual

- Any lineal ascendant or descendant of the individual

- Any lineal ascendant or descendant of the spouse of the individual

- Spouse of the person referred in points 2-6 above

Deductions Allowable in the Income Tax Return

| S.No. | Nature of Income | Deductions |

|---|---|---|

| 1 | Dividend or Interest Income | Any commission or remuneration paid to the bank or any other person for realizing dividend or interest income |

| 2 | Employee’s contribution towards Provident Fund, Superannuation Fund, ESI Fund, or any other fund set up for the welfare of such employees | When a contribution is paid on or before the due date |

| 3 | Rental income letting of plant, machinery, furniture, or building | Rent, rates, taxes, repairs, insurance, and depreciation, etc. |

| 4 | Family Pension | 1/3rd of family pension subject to a maximum of Rs. 15,000. |

| 5 | Any other income | Any other expenditure (not being capital expenditure) expended wholly and exclusively for earning such income |

| 6 | Interest on compensation or enhanced compensation | 50% of interest |

| 7 | Income from the activity of owning and maintaining racehorses. | Expenditure related to such activity |

Deductions not Allowable in the Income Tax Return:

- Personal Expenses.

- Expenditure of the nature specified in section 40A.

- Wealth Tax.

- Interest or Salary payable outside India on which TDS is not deducted when required.

- Expenditure in connection with winnings from lotteries, crossword puzzles, races, games, gambling, or betting.

You can also read this other article for more details

- salary--taxation-and-exemption

- tax-deducted-at-source

- house-property--taxation-and-exemption

- Section-111a-and-112a-of-the-income-tax-act

- Why-company-registration-is-important-for-small-and-medium-businesses

- Set-off-and-carry-forward-of-income-tax-losses

- form-csr-1

- Annual-information-statement-ais--a-new-statement-for-filing-income-tax-return-itr

- What-is-moa-and-aoa

- Difference-between-moa-and-aoa

- Top-secrets-to-run-nidhi-company

- Difference-between-microfinance-company-and-nidhi-company

- Procedure-to-appoint-a-director-of-a-private-limited-company

+91 9828123489

+91 9828123489 +91 9828123489

+91 9828123489 help@vakilkaro.co.in

help@vakilkaro.co.in

.png)

.png)

.png)

.png)

.png)

.png)

+91 9828123489

+91 9828123489 help@vakilkaro.co.in

help@vakilkaro.co.in